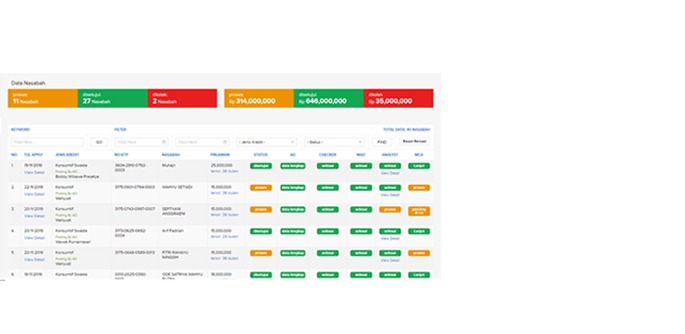

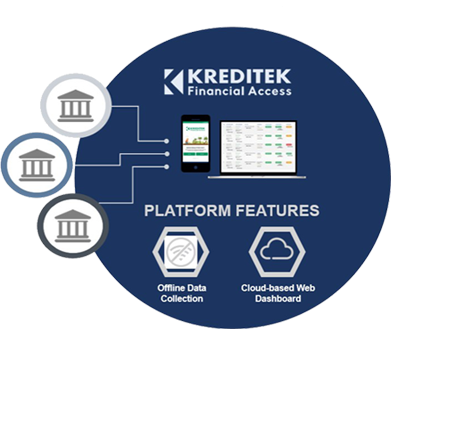

KFA developed a set of technology tools and capacity building programs that can be customized to the needs of the financial institutions. The services we offer include:

- Consulting, development and implementation of credit workflow management and risk assessment tools;

- Development of loan origination, monitoring, reporting, collateral management.

- Customized product design and supply chain financing services;

- Development of alternative lending channels to adjust to needs of financial institutions in the specific area.

+628111388909

+628111388909

support@kreditekfa.co.id

support@kreditekfa.co.id